From Blocks to Stocks

Bitcoin Miners Just Flashed a Major Signal

Hey everyone, and welcome back to the On-Chain Mind Newsletter.

When it comes to Bitcoin, miners are the closest thing we have to insiders. Their reserves, revenues, and behaviour don’t just reflect the network — they often foreshadow where the market is headed.

They operate under constant economic pressure. How they manage coins, cash flow, and infrastructure tells us more about Bitcoin’s underlying health than any chart alone.

In this article, we’ll break down what miners are signalling right now, the structural changes shaping the industry, and what this means for both Bitcoin and mining equities. Ignore them, and you’re missing a big piece of the puzzle.

Let’s get into it.

Insights at a Glance:

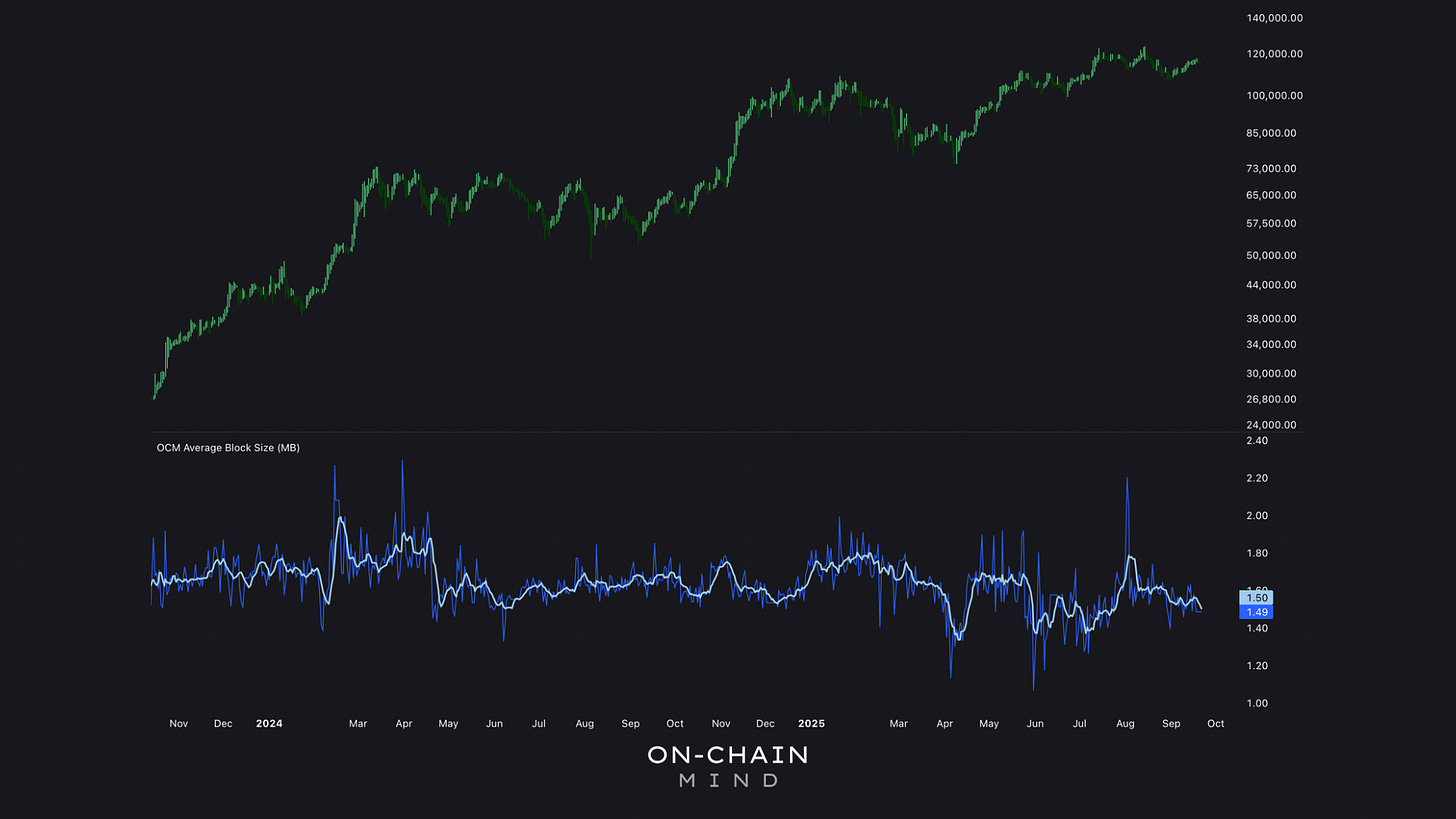

Network Demand Cooling: Average Bitcoin block sizes are down, suggesting quieter activity despite record prices.

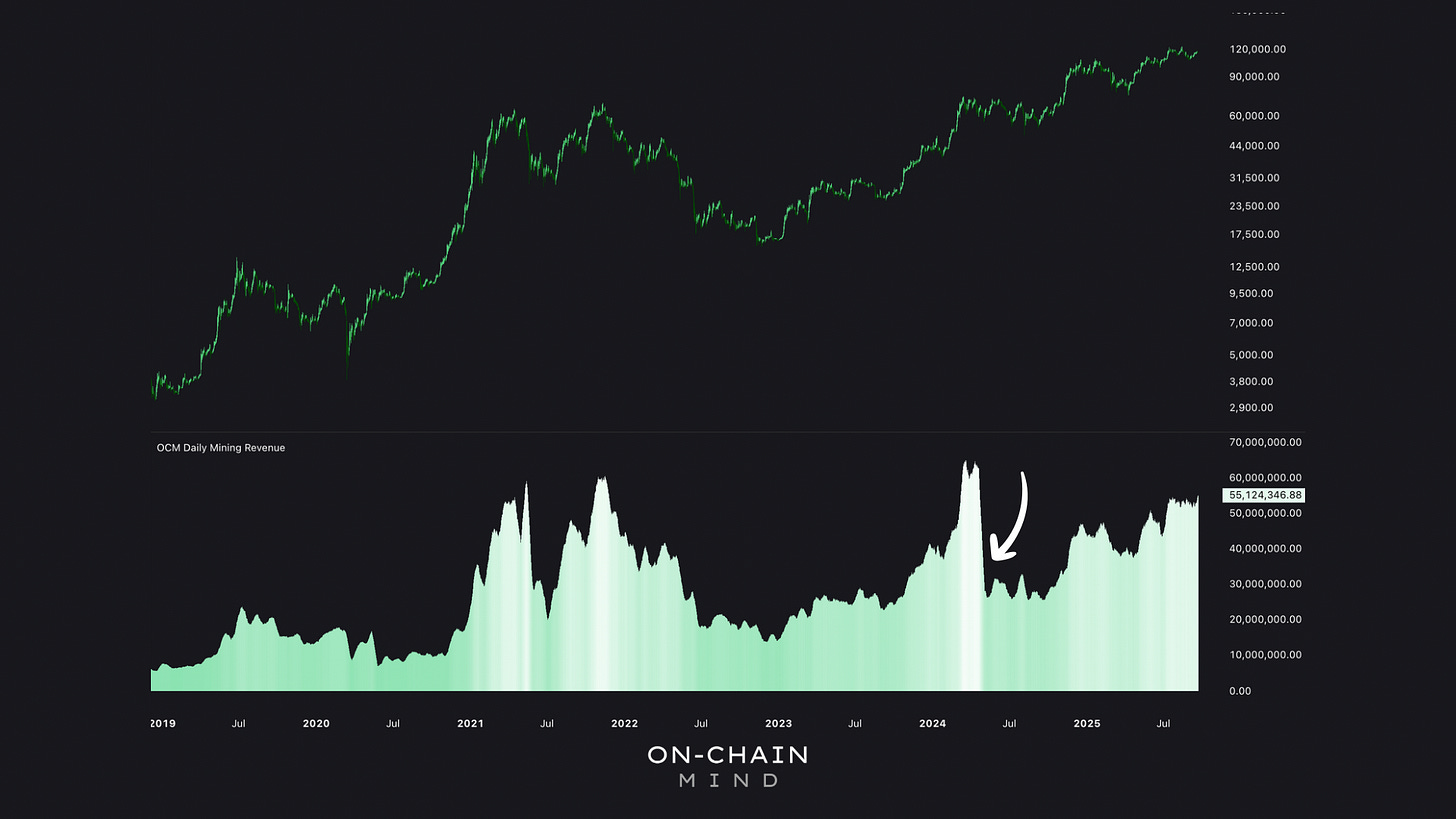

Miner Economics Strong: Daily revenues are at multi-cycle highs, even post-halving.

Structural Change In Reserves: Miners steadily distribute coins instead of hoarding, signalling industrialisation of the sector.

Stocks vs BTC: Mining equities are highly correlated to Bitcoin but currently overbought, making them a risky substitute for holding BTC directly.

The Average Block Size

One of the most straightforward yet revealing metrics is the Average Block Size, measured in megabytes (MB). It’s a measure of how much transaction data is packed into each Bitcoin block.

Historically, Bitcoin’s block size limit was set at 1 MB in its early days, a cap introduced by Satoshi Nakamoto to prevent spam and ensure scalability. But this was later expanded through Segregated Witness (SegWit) in 2017, effectively allowing up to 4 MB per block under optimal conditions.

Today, the average hovers around 1.5 MB, a figure that has dipped slightly in recent months despite Bitcoin achieving record prices. This doesn’t mean Bitcoin is weakening — it simply reflects a temporary easing in demand for block space. What matters is that miner profitability relies heavily on transaction fees, and less crowded blocks reduce their fee income.

This decline isn’t a red flag for network integrity; rather, it suggests a temporary easing in transaction throughput and network usage.

It’s the heartbeat of Bitcoin’s economy — sometimes racing, sometimes steady.

Revenues: A Post-Halving Resilience

Halvings slash block rewards in half every 4 years, and they always spark fear that miners will be forced out of the market. Yet history shows miners adapt — and the latest halving is no exception.

Today, miners collectively earn around $55 million per day, a level only surpassed during the peak of the 2021 bull run and the brief surge to $70,000 just before the most recent halving.

This mining resilience matters because:

It shows the network remains secure despite reduced issuance.

High revenues support reinvestment in infrastructure and scaling.

Strong miner economics provide confidence that hashrate — and therefore security — will continue to grow.

In short, the halving did not cripple miners. Instead, it strengthened Bitcoin’s economic backbone.

Reserves: From HODLers to Businesses

Back in 2019, miners collectively held more than 2.5 million BTC. Today, that figure has fallen below 1.8 million, with no sign of reversal.

This long-term drawdown tells a story of transformation:

Early days: Miners often behaved like investors, hoarding coins as speculative assets.

Now: Mining has industrialised. Operators sell coins consistently to fund operations, reinvest, and manage cash flow.

At first glance, steady selling might look bearish. But in reality, it’s a positive development:

It prevents sudden “supply shocks” if miners were to dump reserves en masse.

It makes Bitcoin’s price discovery less dependent on miners and more reliant on broad market demand.

The decline in miner-held reserves reflects a maturing ecosystem — one where miners play their role as infrastructure providers rather than speculative whales.

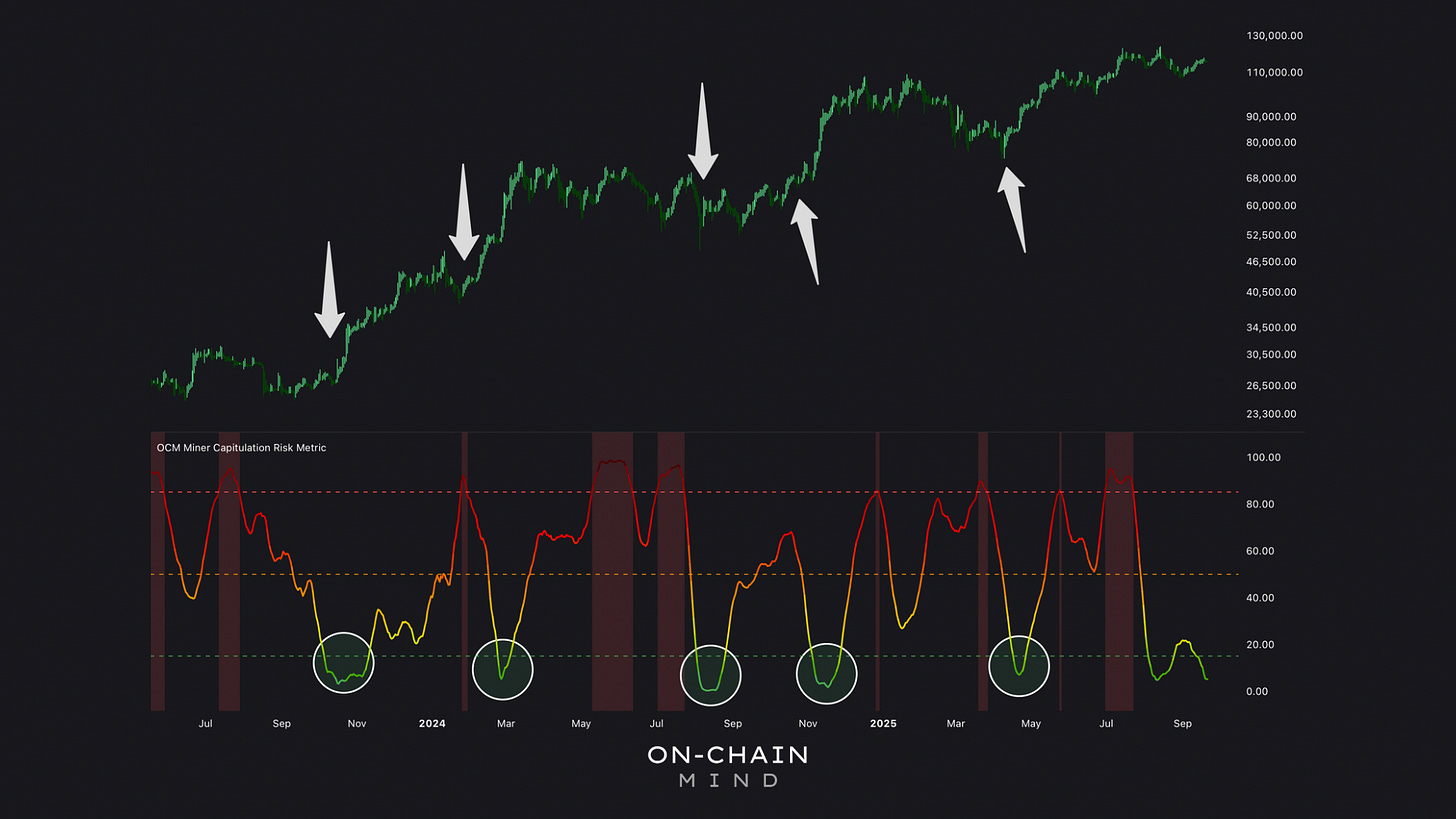

Capitulation Risk Stress Levels

Few things matter more in Bitcoin than whether miners are forced to sell. To track this, we use my Miner Capitulation Risk Metric comparing short-term (30-day) and long-term (60-day) hashrate averages.

Green zones = stable miners, low risk of aggressive selling.

Red zones = stressed miners, higher chance of capitulation.

Right now, the indicator is deeply green. That’s significant because:

It signals miners are financially healthy and unlikely to liquidate holdings.

Historically, such periods often precede strong rallies, as supply pressure is minimal.

Since May 2023, every low-risk reading has been followed by robust upward price movements.

This metric is one of the clearest windows into Bitcoin’s internal health. And today, it says: conditions are calm.

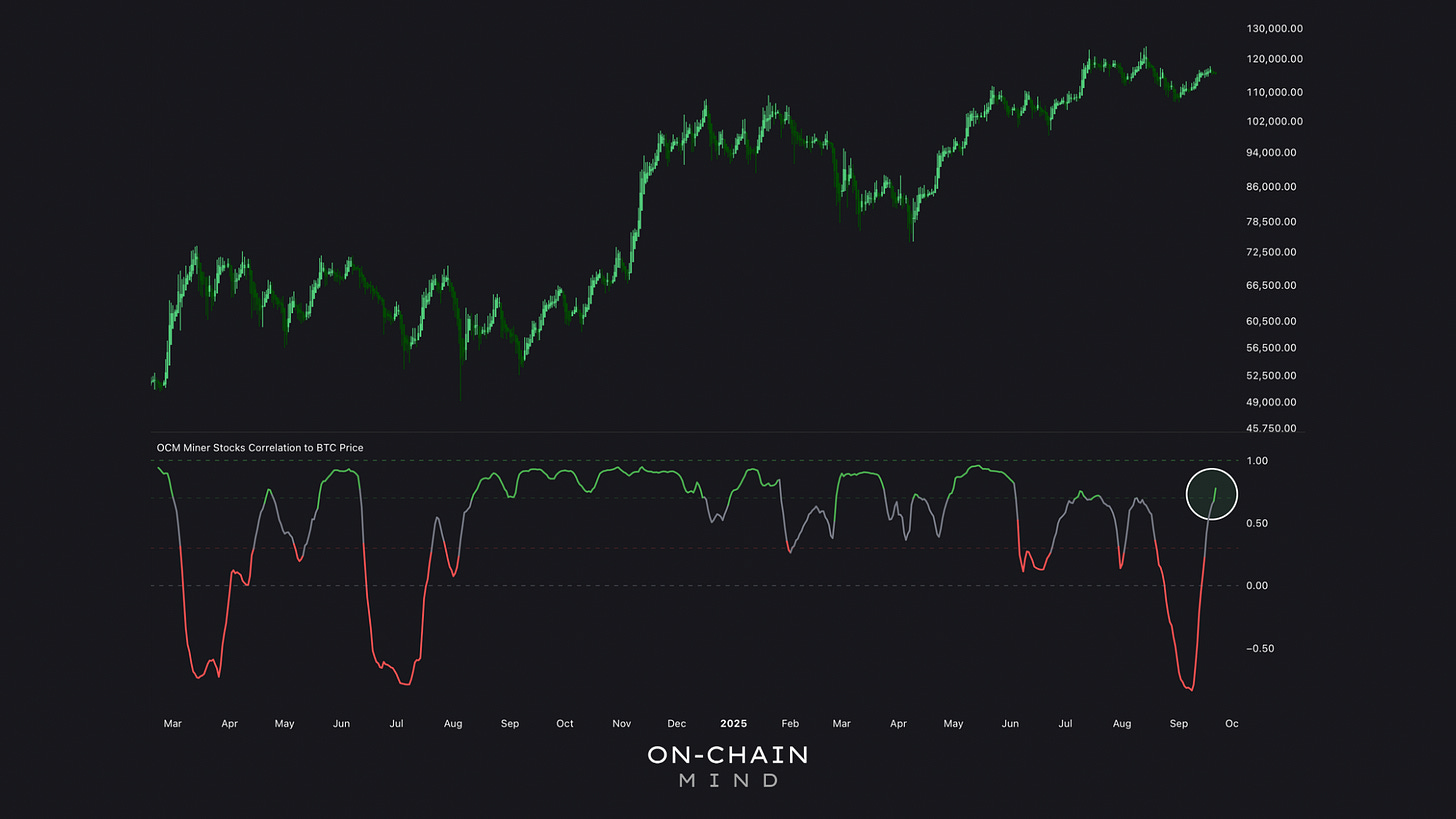

Mining Stocks: A Risky Proxy

Publicly traded mining stocks — such as Marathon, Riot, and Hive — offer investors indirect exposure to Bitcoin. But how do they really behave?

The Miner Stock Correlation indicator tracks how closely these equities follow Bitcoin’s price. At present, the correlation is very high — meaning miner stocks are moving almost lockstep with BTC.

And this matters because:

Mining stocks function like leveraged Bitcoin exposure, amplifying both gains and losses, but not perfectly.

Over most meaningful timeframes, mining equities have underperformed Bitcoin itself.

Unless you have a clear edge, holding large allocations in miners adds volatility without consistent outperformance.

Personally, I wouldn’t allocate more than 5% of a portfolio to miners. They’re tactical plays, not core holdings. The benchmark is, and always will be, Bitcoin.

Mining Stocks RSI:

To gauge stock momentum, we can look at the relative strength index (RSI) of mining equities.

Above/below 50 = bullish/bearish trend.

Above 75 = overbought.

Below 35 = oversold.

Right now, miner stocks (on average) are showing the highest RSI since I started tracking this in early 2024. This is a double-edged sword:

On the one hand, it confirms extreme bullish momentum.

On the other, it warns that the sector is stretched and vulnerable to short-term pullbacks.

Even if Bitcoin rallies further, miner equities may underperform simply because they’ve already run too far, too fast. For me, that means caution is warranted.

Putting It All Together

Stepping back from the data, the picture that emerges is remarkably consistent. Network activity has cooled a little, yet miner revenues remain impressively strong. At the same time, the way miners manage their reserves shows how much the industry has matured — they’re no longer hoarding coins in the hope of future gains but running their operations like proper businesses, selling steadily to fund growth and cover costs. That shift is healthy; it removes the risk of sudden supply shocks and forces Bitcoin’s price discovery to depend more on organic demand.

To me, the most encouraging signal is that capitulation risk is low. Miners are stable, profitable, and not under pressure to sell aggressively, which supports a constructive backdrop for Bitcoin itself. But when it comes to mining equities, I’m cautious. They often move tick-for-tick with Bitcoin, and right now they’re overheated, which makes them a risky substitute for simply owning BTC itself.

For me, the lesson is straightforward: Bitcoin is the benchmark. Mining stocks may offer tactical upside, but their volatility and long-term underperformance mean they’ll never be more than a side play in my portfolio.

Key Takeaways

Network Resilience Post-Halving: Metrics like block sizes and revenues show Bitcoin’s ecosystem adapting well, with miners compensated adequately to maintain security.

Miner Behaviour Shift: Declining reserves indicate a mature industry, reducing sudden supply shocks and promoting organic market growth.

Low Capitulation Risk: Green signals suggest stable conditions, historically aligning with bullish phases and accumulation opportunities.

Tactical Approach to Stocks: High correlations and overbought RSI advise caution — treat mining equities as leveraged bets, not benchmarks, to manage volatility.

If you want to unlock the full picture — including access to my Custom Indicator Suite — consider upgrading to Premium 🚀

I’ll catch you in the next one.

Cheers,

OCM

🎥 Watch the video of this article on YouTube!👇🏼

Subscribe to the On-Chain Mind YouTube Channel!