Is Bitcoin Back?

The Bullish Momentum Building Behind The Scenes

Hey everyone, and welcome back to the On-Chain Mind Newsletter.

Bitcoin's surge back above $100k hasn’t really captured the same level of attention of investors or analysts as last time. And that’s a good thing. With critical technical levels reclaimed and BTC showing strong signs of bullish momentum, can we comfortably say: Is Bitcoin Back? In this article, we’ll break down three key signals that suggest Bitcoin is gearing up for even more upward potential and why Bitcoin is still outperforming traditional assets like equities and gold.

Let’s get into it.

Insights at a Glance:

Technical Breakout: Bitcoin’s climb above its 200-day and 111-day moving averages signals strong bullish momentum with historical precedence for major rallies.

Market Stability: Rising short-term holder profitability is creating a stable foundation, reducing panic selling and setting the stage for sustained growth.

Macro Asset Status: Bitcoin’s outperformance of traditional assets like stocks and gold highlights its growing role as a safe-haven asset in turbulent times.

Bitcoin’s Technical Breakout

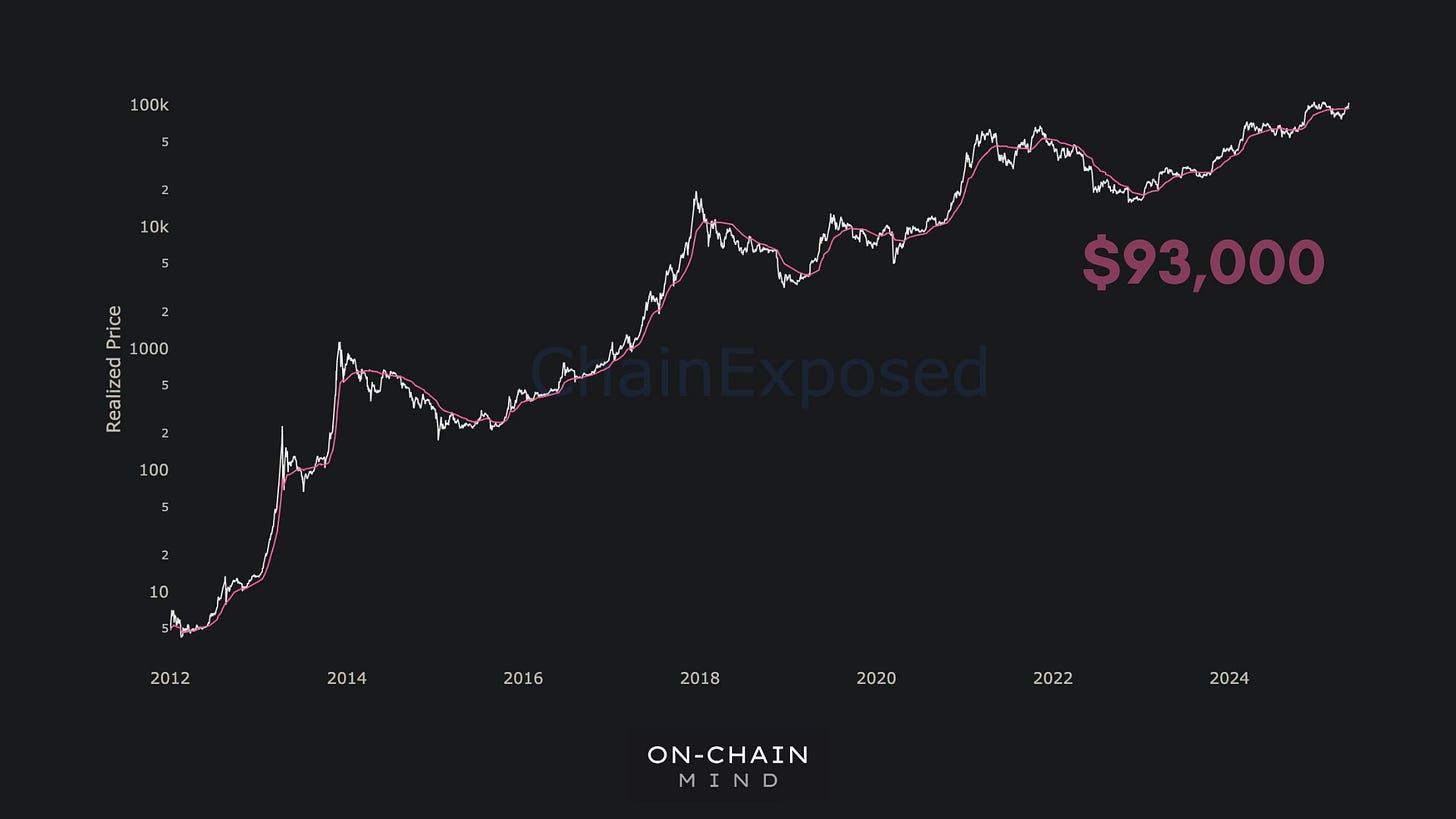

Bitcoin’s price recently broke above its 200-day moving average (MA), an important long-term trend indicator that is typically a strong signal of bullish momentum. Historically, whenever Bitcoin stays above the 200-day MA, it tends to signal that the market is entering an upward phase, often resulting in sustained rallies. The significance of the 200-day MA is not just in its past patterns, but in its current convergence with the 111-day moving average. Right now, both these lines sit around the $91,000 mark, a critical psychological and technical level.

This convergence of the 200-day and 111-day MAs is not something to overlook. In the past, whenever these two indicators converged, Bitcoin's price followed with massive upside rallies. This technical setup has historically acted as a launchpad for significant price increases—provided Bitcoin's price holds above this level. Therefore, the $91,000 zone is arguably one of the most important levels on the chart at this moment.

The Role of Short-Term Holders in Market Stability

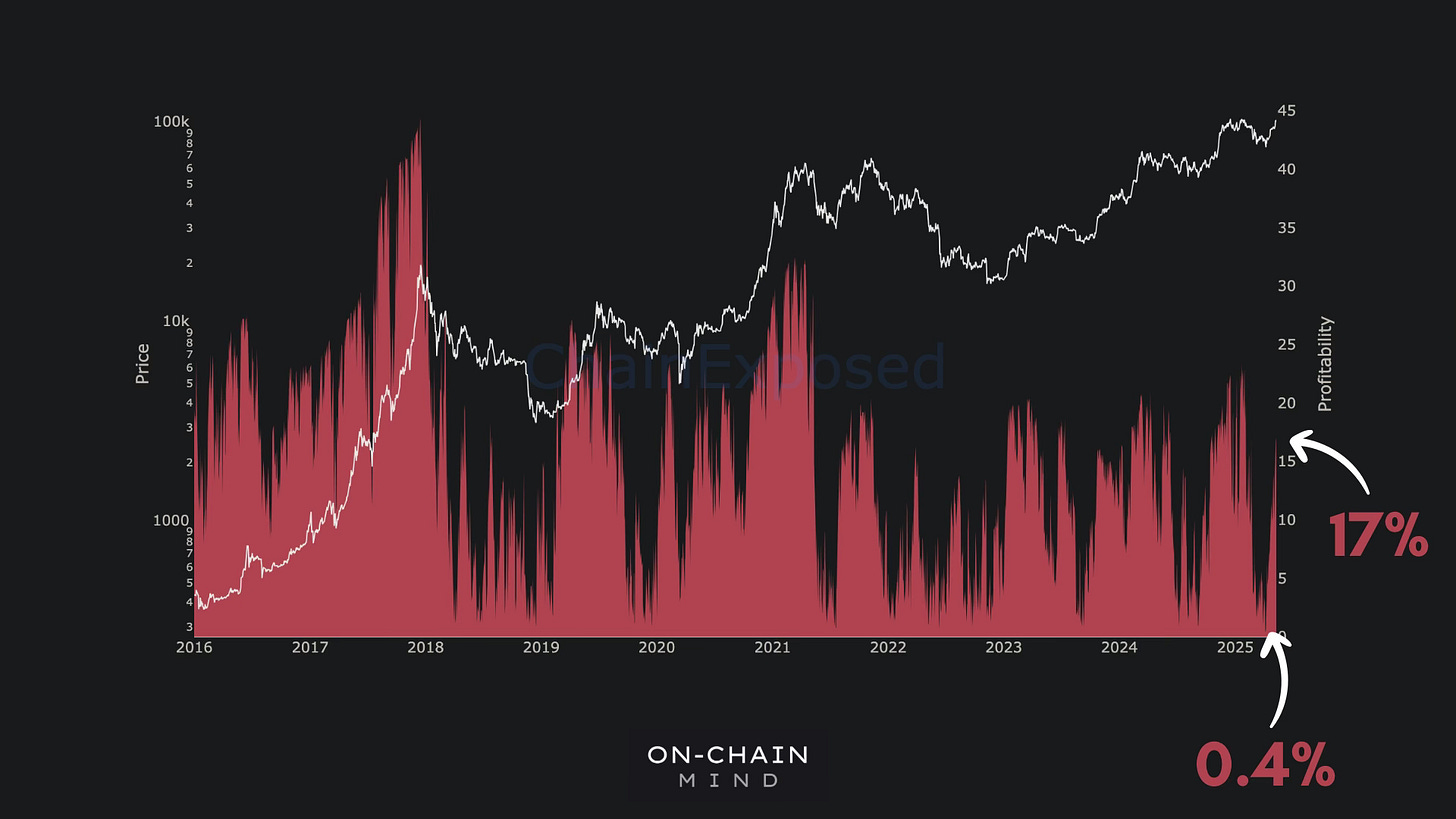

The next critical factor to examine is the behavior of short-term holders—those who’ve bought Bitcoin within the last 155 days. Currently, the average cost basis of short-term holders sits at around $93,000. When Bitcoin’s price exceeds this level, the majority of recent buyers are in profit. And, as history shows, when holders are in profit, they tend to be less emotional and less likely to panic sell, which stabilizes the market.

This stability is crucial for building a solid foundation for long-term growth. During the last market correction, short-term holder profitability plummeted to just 0.4%, meaning fewer than 1% of recent buyers were in profit. This significant downturn signaled the emotional shakeout of many speculators. However, as of now, the profitability of short-term holders has bounced back to about 17%. While still early in the recovery phase, this return to profitability creates a healthy market environment for Bitcoin, without venturing into euphoric territory.

The Role of Coin Age

One aspect of Bitcoin market dynamics that often goes unnoticed by newer investors is the age of coins in circulation. Coins that have been held for more than 139 to 155 days tend to be less likely to be sold in response to short-term price fluctuations. These coins have transitioned from speculative investments to what we call “smart money”. The more of Bitcoin’s supply that ages beyond this threshold, the stronger the base of long-term holders becomes, which in turn bolsters the market’s resilience.

Currently, the Long-Term to Short-Term Holder Ratio is starting to move back into the green zone, indicating that long-term holders are beginning to dominate the market once again. Long-term holders are less likely to dump their positions on every price movement, which helps to create a lower-volatility base for Bitcoin to build upon. This is a crucial factor in fostering a sustainable, stable rally—one that is not based on short-term speculation but rather on strong investor confidence.

Bitcoin as “The” Macro Asset

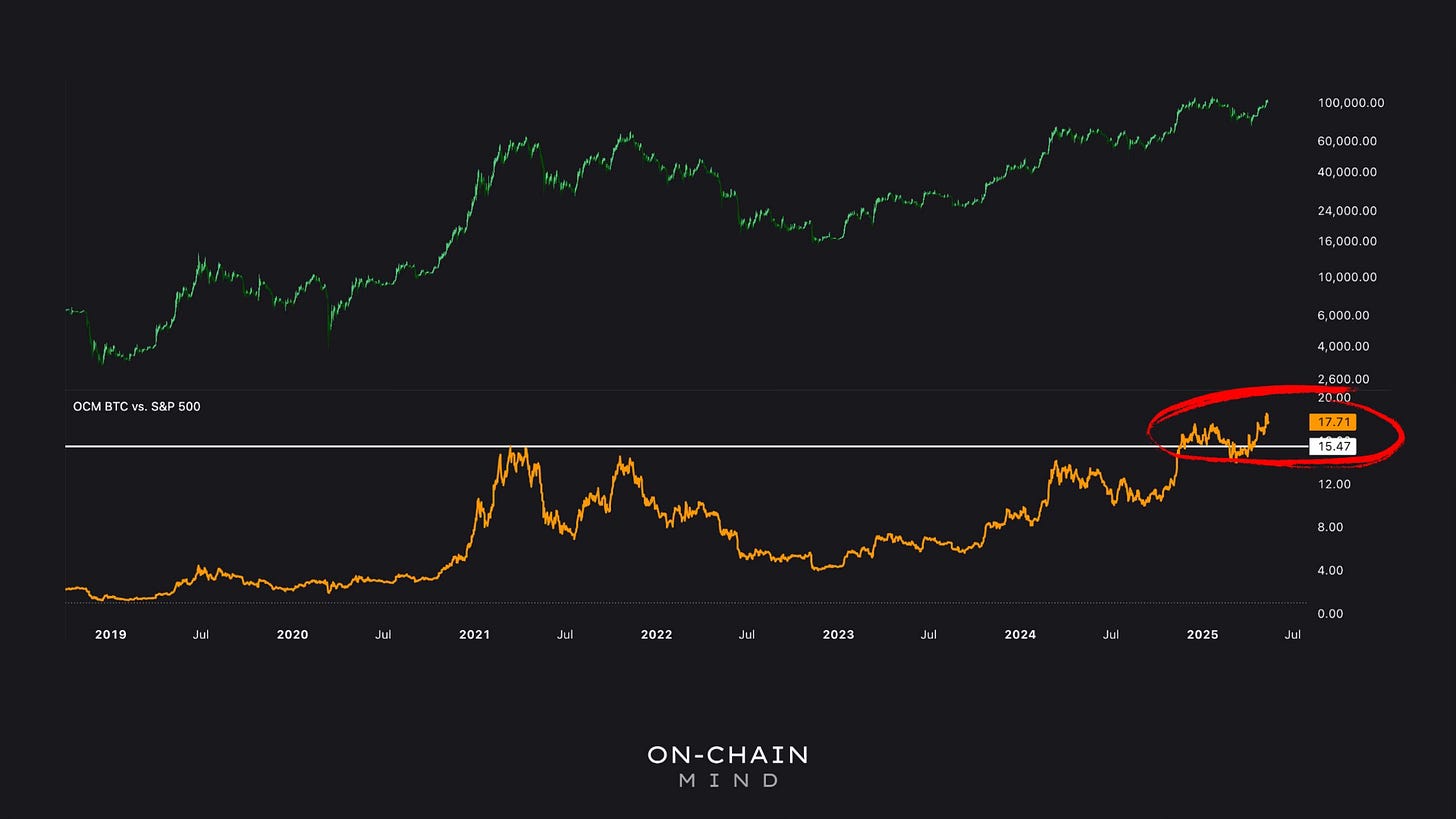

Bitcoin’s performance against traditional equities and commodities is also a major indicator of its growing strength. Since Bitcoin’s breakout in early April 2023 (referred to as “Liberation Day”), Bitcoin has outperformed the S&P 500 by an impressive 13% in just a matter of weeks. This rapid outperformance highlights Bitcoin’s potential as an alternative investment and its increasing appeal as a hedge against broader market trends.

One of the most significant ways to measure Bitcoin’s strength against traditional assets is by comparing how many shares of the S&P 500 are needed to purchase one Bitcoin. Currently, it takes around 17.7 shares of the S&P 500 to buy one Bitcoin—this is the highest ratio Bitcoin has ever reached. This trend is particularly powerful because it reinforces the narrative of Bitcoin as a macro asset, not just a high-risk tech bet. Investors are beginning to view Bitcoin not only as a speculative asset but also as a safe-haven store of value when the global economic outlook turns uncertain.

But Bitcoin’s outperformance is not just limited to traditional equities. Bitcoin is also beating the NASDAQ 100, a well-regarded index known for its high-growth tech stocks. Right now, it takes nearly 5 NASDAQ shares to buy a single Bitcoin. This signals a significant shift in capital rotation, with money flowing out of big tech and into Bitcoin. Investors are moving away from speculative tech stocks and seeking the perceived safety of Bitcoin.

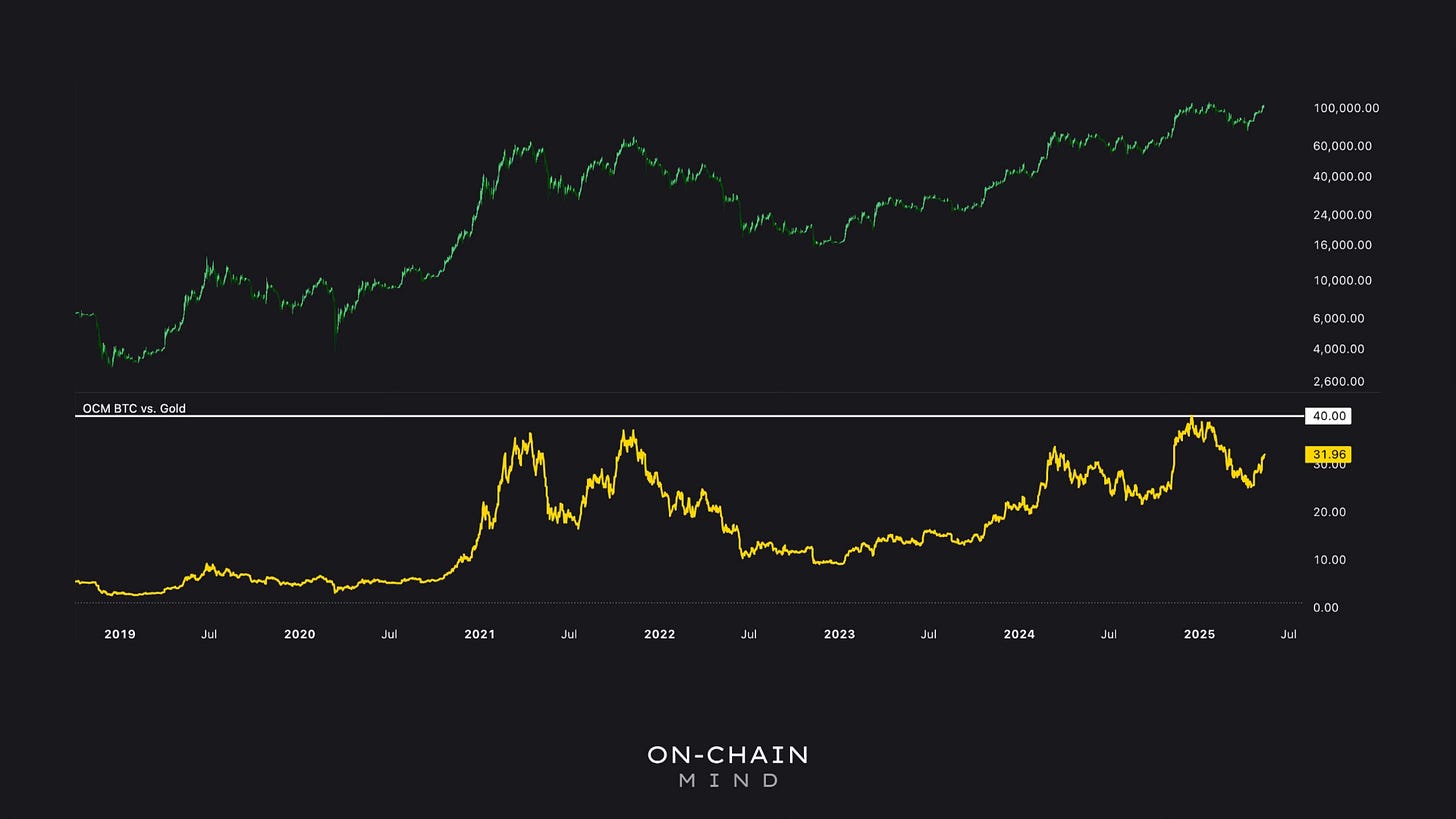

When comparing Bitcoin to gold—the traditional king of store of value—Bitcoin’s performance becomes even more impressive. Although Bitcoin hasn’t yet hit new all-time highs when priced in gold, it is fast closing the gap. Historically, the value of Bitcoin has been compared to gold because both assets are seen as stores of value, particularly during times of economic uncertainty. In recent years, Bitcoin’s value relative to gold has been steadily rising. As of now, it takes about 32 ounces of gold to buy one Bitcoin—and it is closing in on 40 ounces all-time-high set not long ago. Given gold’s own strong performance due to inflation concerns, geopolitical risks, and fiat currency instability, Bitcoin’s rising value in gold terms shows its growing appeal as a store of value.

Key Takeaways

Critical Technical Levels: Bitcoin’s breakthrough above the 200-day moving average, coupled with the convergence of the 111-day moving average, signals strong bullish momentum.

Market Stability: Short-term holders are moving back into profitability, creating a more stable market environment that lays the foundation for sustained growth.

Capital Rotation: Bitcoin is outperforming traditional assets like the S&P 500, NASDAQ, and gold, signaling a shift toward Bitcoin as a safe-haven asset.

Long-Term Bullish Potential: With growing institutional and investor confidence, Bitcoin’s future is looking increasingly bright as it matures into a more dominant store of value.

I’ll see you in the next one.

Cheers,

On-Chain Mind

🎥 Watch the video of this article on YouTube!👇

Subscribe to the On-Chain Mind YouTube Channel!

One of the questions I am glad I needn't ask myself or others! But feel “free” to…