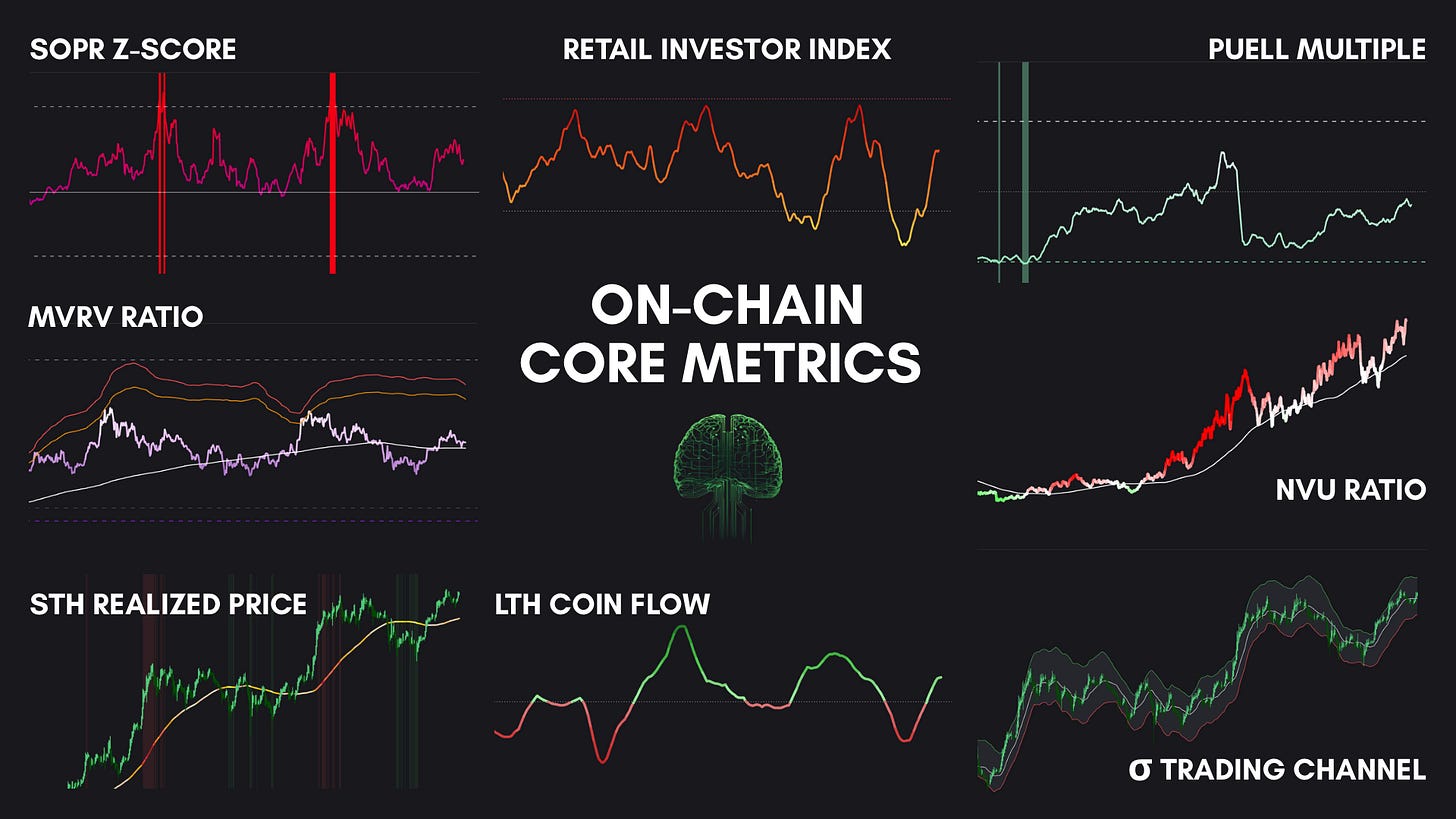

📊 On-Chain Core Metrics Snapshot

The 8 Critical Metrics Every Bitcoin Investor Must Watch

Below are my 8 core on-chain metrics that give you a clear snapshot of market health, sentiment, and valuation — the must-watch indicators if you only have a few minutes today.

SOPR Z-Score:

Score: 1.02

Investors are selling at a profit, but not excessively so

MVRV Ratio:

Score: 2.2

Above 1-year MA, but nowhere near upper σ bands

Short-Term Holder Realized Price:

Dynamic UTXO-weighted price: $95,000

Trading above STH cost basis, but no spike signals currently

Long-Term Holder Coin Flow:

Positive selling flow from coins > 1 year, but not in excessive amounts

σ Trading Channel:

Channel: $97,000 - $118,000

Trader Fair Value: $106,000

NVU Ratio:

21% above trend

Market cap is modestly outpacing active users, indicating healthy growth without overextension.

Retail Investor Index:

Positive retail flow

Retail cohort re-entering after capitulation around $75,000

Puell Multiple:

Score: 1.31

Above historical average. Miner profitability healthy but not yet at an extreme peak

Summary

Bitcoin’s on-chain data paints a picture of a healthy, maturing market. Valuation ratios like the MVRV and NVU show the market is above trend but not stretched, suggesting room for continued growth without major froth. Profit-taking is present but not excessive, and retail participation is picking back up after recent consolidation, which is a sign of rebuilding confidence. Overall, the data leans constructive, with no major signs of speculative extremes in sight.

I’ll see you in the next one.

Cheers,

On-Chain Mind

Subscribe to the On-Chain Mind YouTube Channel!