Why MSTR is Still Outperforming Everything Else

A Masterclass in Bitcoin Strategy

Hey everyone, and welcome back to the On-Chain Mind Newsletter.

MicroStrategy (now known as “Strategy”) has now acquired over 528,000 BTC and continues to outperform Bitcoin, the NASDAQ, and the S&P 500 by a wide margin. Since 2020, this software-turned-Bitcoin-treasury company has redefined corporate investing, delivering staggering returns while amplifying exposure to the world’s leading crypto. In this article, we’ll unpack MicroStrategy’s latest performance, explore why it continues to outshine traditional markets, and analyse what its valuation metrics reveal about its current position.

Let’s get into it.

Insights at a Glance:

Strategy now delivers more Bitcoin per share than ever: and it’s still growing.

Outperformance continues: Strategy beats Bitcoin, NASDAQ, and the S&P 500 on both CAGR and total return.

Valuation is neutral: Indicators like MVRV and custom momentum metrics suggest a balanced market.

DCA wins: dollar-cost averaging in a balanced valuation environment is a smart strategy for long-term investors.

The Bitcoin Bet That Paid Off—Big Time

MicroStrategy began accumulating Bitcoin in 2020 as part of a bold shift in corporate treasury strategy. Today, it holds over 528,000 BTC—more than 2.5% of Bitcoin’s maximum total supply. Let’s unpack what this means for investors and why the market continues to reward this approach.

Strategy’s Bitcoin Holdings – A Snapshot

Total BTC held: 528,000+

Average purchase price: ~$67,000

BTC as % of all Bitcoin ever to exist: ~2.5%

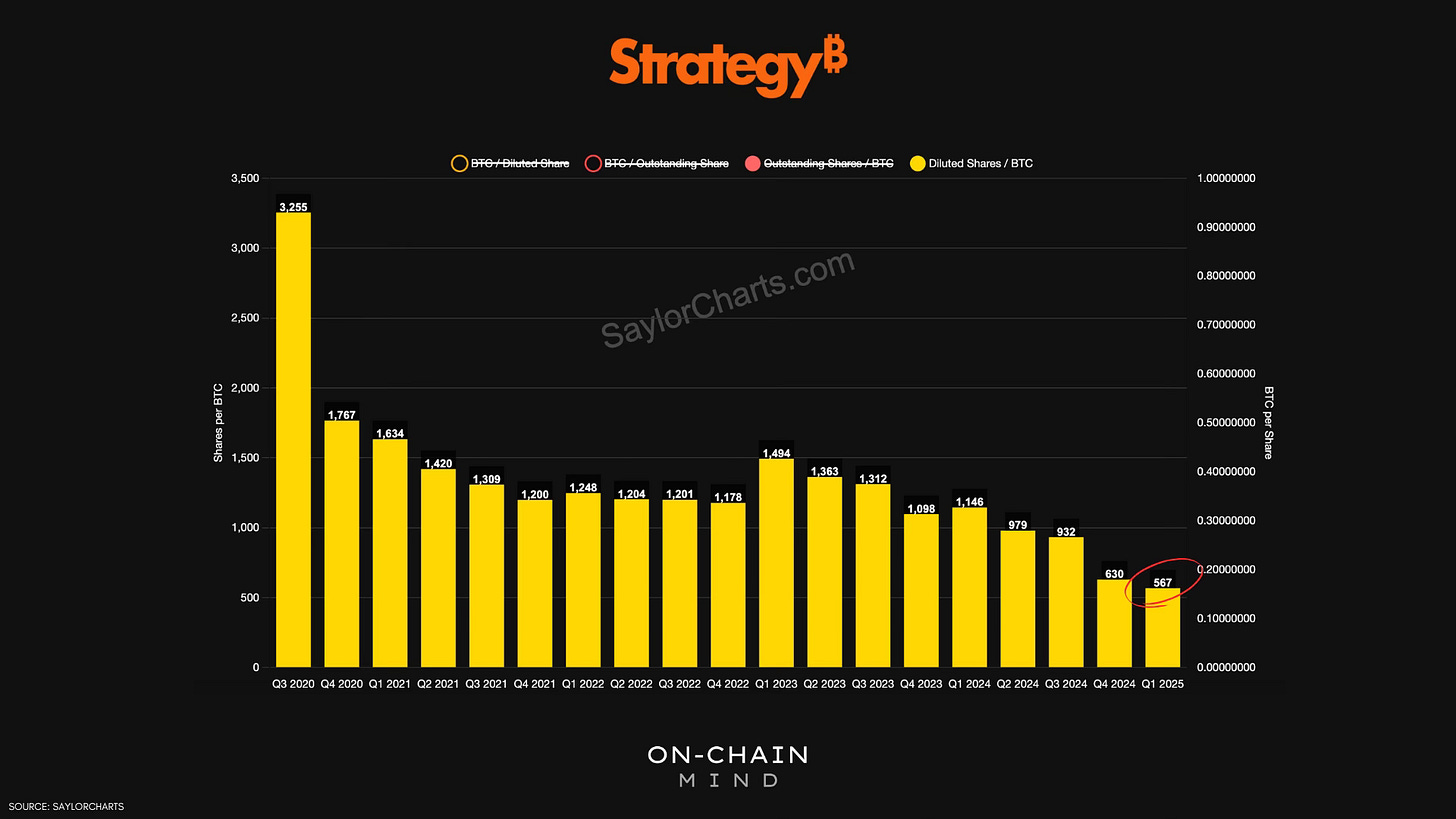

Current BTC equivalent per share: 1 BTC = 567 shares

Satoshis per diluted share: 176,000+

2025 Bitcoin yield so far: 11%

Bitcoin per share is increasing over time, not decreasing—even accounting for share dilution. That’s the secret. While traditional companies aim to buy shares back to increase shareholder value, MSTR is purposely diluting shareholder value with share issuance. However, due to their increased Bitcoin premium, Strategy’s clever financial engineering turns this into an advantage by acquiring more BTC per share over time.

By issuing equity, convertible debt, and other financial instruments, the company acquires more BTC without relying solely on cash reserves. This approach amplifies returns when Bitcoin’s price rises, as each share represents a growing slice of the company’s Bitcoin holdings. For investors, this creates a unique opportunity to gain leveraged exposure to BTC without the complexities of direct Bitcoin ownership.

The Bitcoin Yield

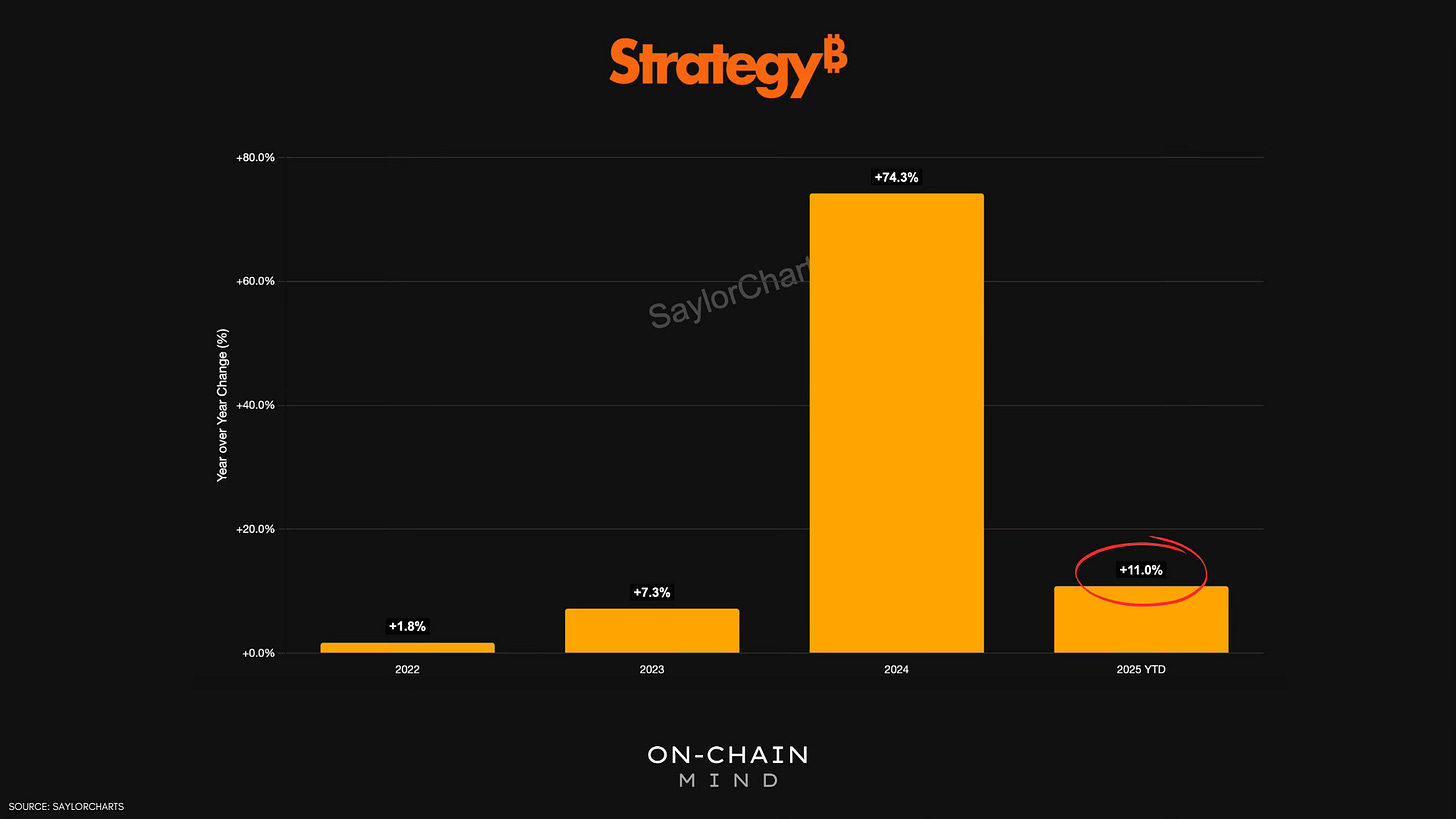

The Bitcoin Yield is a crucial metric that measures the growth in Bitcoin (or Satoshis) per share, after accounting for dilution.

In early 2025, that figure is 11%.

Compare that to 6.9% in the previous update.

In plain terms: you’re gaining more BTC exposure per share than you would by just holding spot Bitcoin.

Why does this matter?

Strategy amplifies your exposure to Bitcoin.

It adds alpha through capital management—buying BTC with debt, equity, or surplus cash.

The yield isn’t theoretical—it shows up in your effective BTC per share.

This is how Strategy becomes not just a tracking mechanism, but a Bitcoin performance accelerator.

Absolute Performance vs. Everything Else

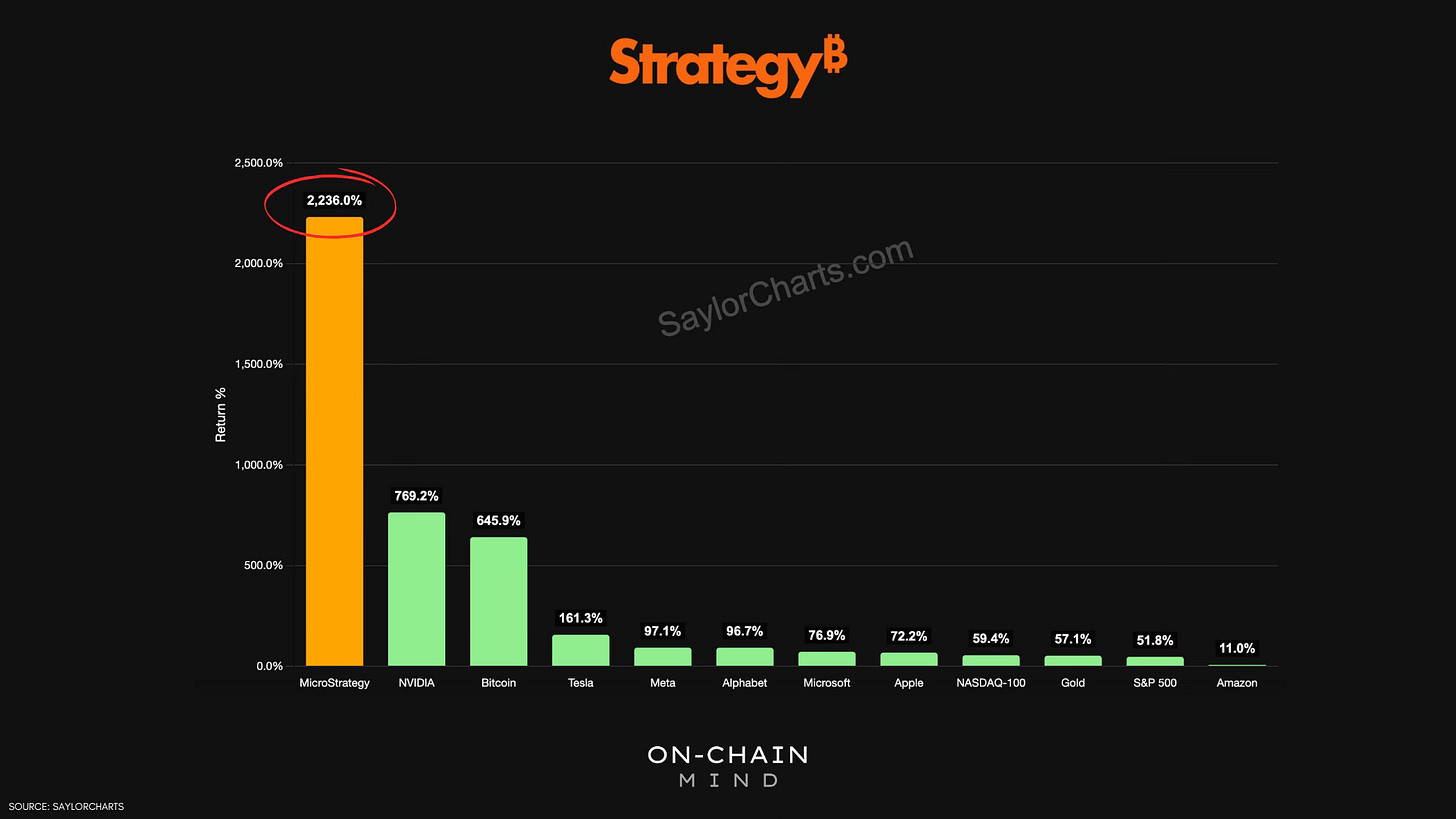

Let’s zoom out and compare Strategy to the rest of the financial universe. MSTR’s Bitcoin strategy has delivered returns that are nothing short of extraordinary. Since August 2020, the company has achieved:

Total Return: A jaw-dropping 2,200% return, making it the best-performing asset over this period.

Compound Annual Growth Rate (CAGR): An annualized growth rate of 96%, compared to Bitcoin’s 53%, the NASDAQ’s 10%, and the S&P 500’s 9%.

To put this in perspective, an investment of $10,000 in MSTR in August 2020 would be worth $220,000 today. The same investment in Bitcoin would have grown to about $36,000, while the NASDAQ and S&P 500 would have yielded roughly $16,000 and $15,000, respectively. These numbers underscore Strategy’s ability to amplify Bitcoin’s upside while outperforming traditional markets.

Valuation Metrics: Is MSTR a Buy?

To assess whether MSTR is a good investment today, let’s examine its valuation through several key metrics. These tools provide a snapshot of the stock’s current pricing relative to its Bitcoin holdings and historical trends.

1. MVRV Ratio

What It Is: The Market Value to Realized Value (MVRV) ratio compares MSTR’s market value to the realized value of its Bitcoin holdings (based on acquisition costs).

Current Value: 1.2

Interpretation: At 1.2, the MVRV ratio suggests MSTR is fairly valued. The current reading reflects a balanced market, neither gripped by greed nor fear.

2. Velocity RSI

What It Is: A custom momentum indicator that combines price movement and the speed of change.

Current Status: After hitting its lowest level since 2023, the Velocity RSI has rebounded to a mid-range level.

Interpretation: This indicates a cooling-off phase, with the stock neither overheated nor oversold. It sets the stage for potential accumulation or a breakout, depending on broader market conditions.

3. Z-Score Probability Waves

What It Is: A statistical tool that measures how far current prices deviate from the historical mean, expressed in standard deviations.

Current Range: Prices are near the mean, with a 3-standard deviation range of $215 (lower) to $378 (upper).

Interpretation: Trading near the mean suggests a neutral zone. Prices hitting the upper or lower bands often precede powerful moves followed by mean reversion.

4. Bitcoin Holdings Price Bands

What It Is: A valuation framework based on the value of Bitcoin per share.

Current Range: $178 (lower boundary) to $577 (upper boundary), with the stock trading near the midpoint.

Interpretation: The midpoint position indicates no major mispricing, offering a stable entry point for patient investors.

These metrics collectively paint a picture of equilibrium. MSTR is neither a screaming bargain nor wildly overpriced. This balanced valuation is ideal for dollar-cost averaging (DCA), where investors steadily buy shares over time to smooth out volatility. For long-term investors, this environment minimises the risk of buying at euphoric highs or panic-driven lows.

Valuation metrics like the MVRV ratio and Velocity RSI reflect investor sentiment as much as financial fundamentals. In a balanced market, fear and greed are subdued, creating opportunities for disciplined investors. However, Bitcoin’s volatility means sentiment can shift rapidly. Staying up to date with macro trends, such as Federal Reserve policy or further institutional Bitcoin adoption, can help you anticipate price swings and adjust your strategy accordingly.

My Insights for Investors

MSTR’s story is inspiring, but how can you apply its lessons to your own investment approach? Here are four actionable insights to consider:

Embrace Dollar-Cost Averaging (DCA):

Why: In a fairly valued market, DCA allows you to build exposure without chasing highs or panicking at lows.

How: Set a fixed monthly investment in MSTR or Bitcoin, regardless of price fluctuations. Over time, this smooths out volatility and reduces emotional decision-making.

Example: Investing monthly in MSTR at current valuations could build significant Bitcoin exposure over a decade, especially if Bitcoin’s price continues its long-term upward trend.

Understand Leverage and Risk:

Why: MSTR’s leveraged Bitcoin strategy amplifies returns but also increases volatility.

How: Assess your risk tolerance. If you’re comfortable with higher volatility, MSTR may be a compelling alternative to holding Bitcoin directly. If not, consider a mix of direct BTC ownership and MSTR shares.

Reflection: Ask yourself: Am I prepared for 30-50% drawdowns in pursuit of outsized gains?

Monitor Valuation Metrics:

Why: Metrics like the MVRV ratio and price bands help identify buying or selling opportunities.

How: Stay up to date on my Twitter/X: @OnChainMind where I track many Bitcoin and MSTR related valuation metrics.

The Bigger Picture

By betting big on Bitcoin, MSTR has not only transformed its own fortunes but also challenged conventional wisdom about corporate treasuries. Its 2,200% return since 2020 is a testament to the power of conviction in an emerging asset class.

For investors, MicroStrategy offers a unique way to gain Bitcoin exposure through a publicly traded stock, complete with the benefits of liquidity and regulatory oversight. Its 11% Bitcoin yield and 96% CAGR highlight the potential for outsized returns, but they also come with heightened volatility. The current valuation—balanced, neither cheap nor expensive—suggests a window of opportunity for disciplined investors.

Its future hinges on Bitcoin’s trajectory. If Bitcoin continues its historical growth, driven by increased global demand, MSTR’s leveraged exposure could deliver even greater returns. For now, its neutral valuation and strong fundamentals make it a compelling option for those bullish on Bitcoin’s long-term potential.

Key Takeaways

MSTR’s Bitcoin Yield: The company delivers 11% more Bitcoin per share than holding BTC directly, thanks to its capital-efficient strategy.

Unprecedented Returns: With a 96% CAGR and 2,200% total return since 2020, MicroStrategy has outperformed Bitcoin, the NASDAQ, and the S&P 500.

Balanced Valuation: Metrics like the MVRV ratio (1.2) and Bitcoin price bands indicate MicroStrategy is fairly valued, ideal for dollar-cost averaging.

Actionable Strategy: Use DCA, monitor valuation metrics, and stay up to date on Bitcoin’s macro context to build a disciplined investment approach.

I’ll see you in the next one.

Cheers,

On-Chain Mind

🎥 Watch the video of this article on YouTube!👇

Subscribe to the On-Chain Mind YouTube Channel!